EUR/CAD analysis | Sep 4, 2019

- KeonConsultancy.com

- Sep 4, 2019

- 1 min read

As per our last analysis of EUR/USD, we may short/sell EUR/USD if we get bearish candle pattern after it reaches immediate resistance i.e. around 1.1026 or any other resistance area wherever we get bearish candle pattern on 30 minutes or 15 minutes time-frame.

Our last analysis of USD/CAD has suggested fall and the bearish context has also been supported by BOC statement today. And we have a sell limit in USD/CAD now.

Therefore, if we get bearish pattern in EUR/USD by the time our sell limit gets triggered in USD/CAD; we can short/sell EUR/CAD and hold onto it until USD/CAD meets target or EUR/USD meets target, whichever occurs earlier.

We may get supporting technical scenario on EUR/CAD, that is described below:

On daily time-frame: Daily trend is already down because price stays well below trend-predictor (red MA on chart) as well as MACD shows same thing. There is no divergence that can contradict with our bearish idea.

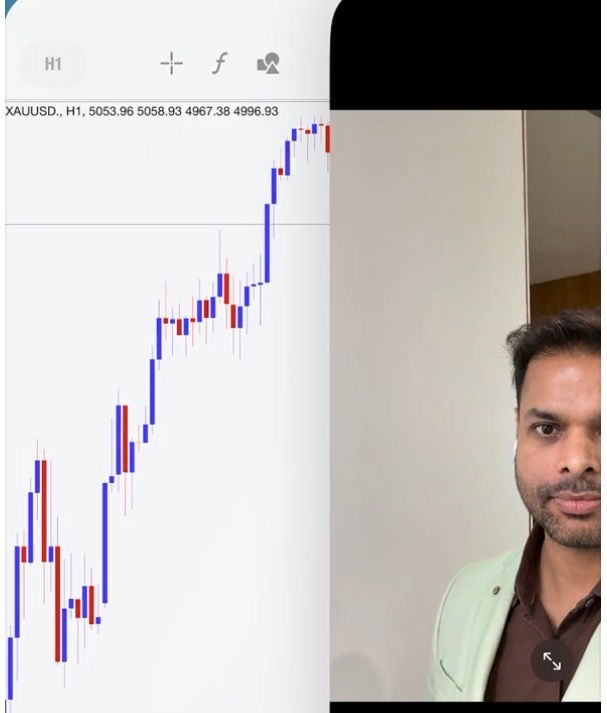

On 1 hour time-frame: Bearish engulfing candle is forming. RSI crosovver below 50 as well as MAs crossover is gonna take place.

No such opportunity.