EUR/USD trade with Gartley pattern

- KeonConsultancy.com

- Dec 10, 2019

- 1 min read

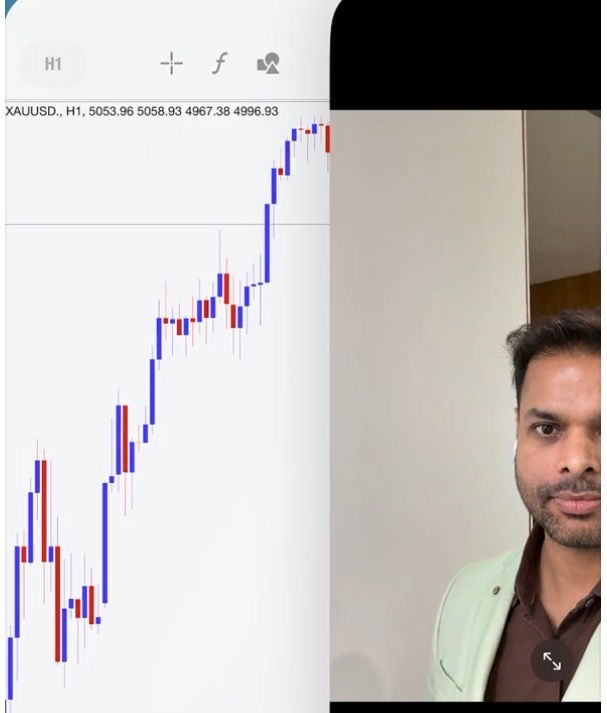

It made a Gartley on H1 time-frame. It is very harmonic because AB is equal to CD, ABCD100% extension in other words as well as speed of AB & CD is same. ABCD100% coincides with FIB 78.6% of XA, which also makes it a significant area. It formed a shooting star which is a bearish pattern too.

This Garltley is bearish reversal pattern which has capability of erasing entire move from A to D, however minimum target of Gartley is said to be 30% retracement against AD. I'm going to hold onto sell until release of Fed statement tomorrow.

Bearish engulfing candle on D1 is still valid because movement of yesterday and today could not penetrate opening point of that candle. Don't be mistaken by the morning star because it's invalid. Reason of its invalidation:

1. Fed decision tomorrow will take over any technical scenario. Recent good NFP and other good economic data, good stock market etc doesn't make any ground for Fed to be dovish tomorrow. In recent weeks, almost all major countries held rate, which also put no pressure on fed to cut rate or signal any future rate cut now.

2. Morning star is a bullish reversal pattern and it is valid when it is formed after a downswing. This one has been formed after an upswing, which makes it invalid.

1 Comment