Pre-release FOMC projection analysis & trading plan, Sep 22, 2021 | Keon Consultancy

- KeonConsultancy.com

- Sep 22, 2021

- 1 min read

Here are our view on FOMC statement to be released today.

Federal funds rate (<0.25%) and current QE ($120 bn) are more like to stay unchanged because of weaker jobs report despite annual inflation surged to 5.3% (Aug 2020 - Aug 2021),

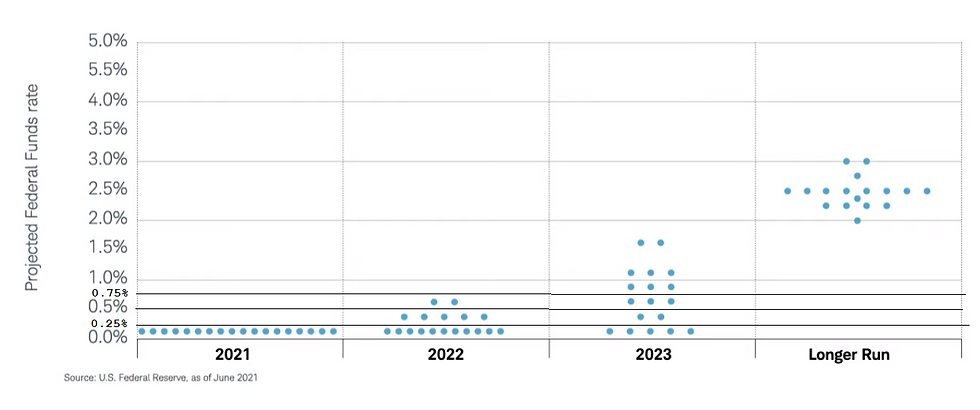

Forex traders will pay attention to Dot Plot of Federal Fund Rate Projection to be released today, which is more likely to inch toward earlier hike. Current Dot Plot is shown below:

Click here at/after 2 p.m. N.Y. time to open the FOMC projections document and go to the 4th page of the document to see today's released Dot Plot.

Trading plan: Let's understand what happened in June's FOMC economic projection. Look at the 4th page of FOMC March's projections and the same page of FOMC June's projections to understand the change in Dot Plot. This hawkish change had caused a 100.0 pips fall in EUR/USD within an hour after release of FOMC statement, and the bearish move had continued for next two more days.

If we see the hawkish shuffle in the dots today, sell EUR/USD; otherwise buy EUR/USD.

EUR/USD hit the target.

Sold EUR/USD @ 1.1742 after initial spike up, targeting 1.17.