NZD/JPY | Sep 16, 2019

- KeonConsultancy.com

- Sep 16, 2019

- 1 min read

If you have read our previous analysis of NZD, you know that we are planning to sell it. We have bearish context on NZD/CHF as well as on NZD/JPY.

Conservative plan: Split the trade into two trades. Half in NZD/JPY and half in NZD/CHF.

Note: During whole period of US-China trade war, JPY as well as CHF kept strengthening. JPY has been the biggest gainer while CHF been the 2nd biggest gainer. Therefore, we are selling NZD not against USD but against CHF and/or JPY.

Aggressive plan: Keep the one whose sell limit gets triggered first and delete. E.g. if NZD/JPY gets triggered first, delete NZDCHF.

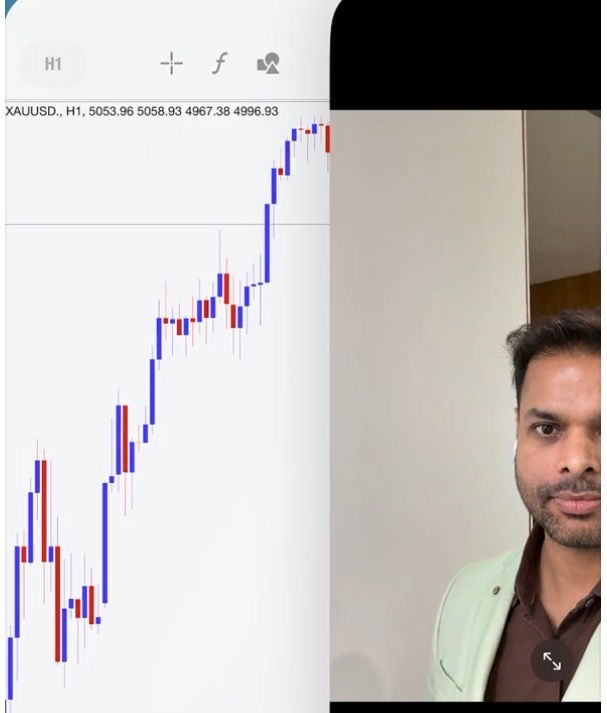

In NZDJPY, at one hour/H1 time-frame, we are planning to sell at 30% retracement level of recent swing down.

Risk: This setup fails if daily/D1 candles close above whole swing up on daily time-frame.

Target: 50% of whole swing up on daily time-frame

Comments