NZD/USD analysis | Nov 13, 2019

- KeonConsultancy.com

- Nov 13, 2019

- 1 min read

The 3-drive mentioned in previous analysis has completed its minimum target on Nov 08 as price closed below low of Oct 30. Besides this technical factor, the fundamental factor of the fall was probability of Official Cash Rate Cut. But RBNZ didn't cut OCR today and this surprise built bullish scenario back again as the price erased fall of almost last six trading days in minutes. Not only did it erase the fall but also stayed around 0.6400 until end of RBNZ press conference. In press conference, governor Orr said that economy as per his assessment is doing well, so he doesn't see a need of rate cut.

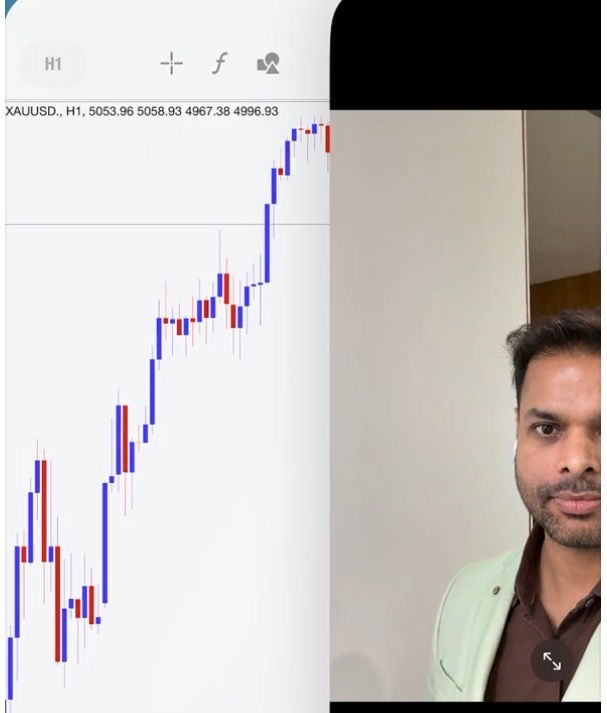

On daily/D1 time-frame: target is where ABCD161.8 & abcd61.8 coincides, this area also makes a resistance cluster with FIB50.0 of whole swing down and previous swing lows.

On H1 time-frame: Overbought RSI makes a ground for some downward correction/retracement. FIB50.0 coincides with previous swing high, which makes this price level a significant support. If the pair retraces down to this support level, there is high probability that it may return back to upside from here. Therefore, we have a buy limit here. However, we cannot be sure that it will retrace down to this support level, so we have already entered half buy position and kept half for buy limit.

Moved SL to BE. We have two split positions, so actual BE is the average of BEs of the two.

The buy limit was activated as NZD/USD retraced down.