NZD/USD analysis | Oct 30, 2019

- KeonConsultancy.com

- Oct 31, 2019

- 1 min read

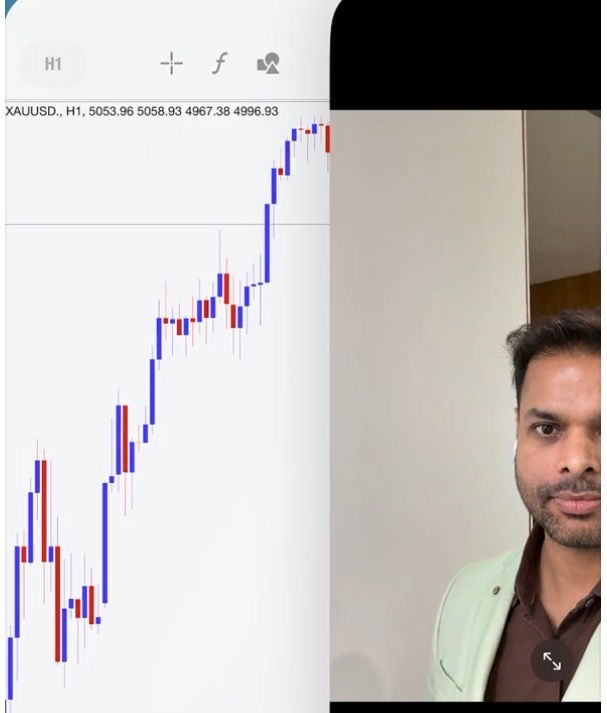

NZD/USD had already been trying to form bottom since Oct 28 around FIB50.0, then Fed rate cut and dovish FOMC press conference today helped it start bullish move.

Today's daily candle is most probably closing above trend predictor (red line), that technically will shift the trend back to bullish.

Either we can enter one trade with two targets, one at ABCD161.8 (-3.0 pips) and another at abcd61.8 (-2.0 pips) or we can split our entry in two trades with two different targets.

Risk: SL 2.0 pips below the bottom (precisely below low of the downward spike caused today during FOMC press conference).

Modification:

Set buy limit 1.0 pips+spread above FIB50.0 of recent move up on H1.