Sell CAD/JPY

- KeonConsultancy.com

- Dec 5, 2019

- 1 min read

After a significant gain following BOC rate statement, CAD was supposed to retrace a little and all we needed was a triggering factor. We got the triggering factor in form of what BOC's Deputy Governor Timothy Lane said.

Following OPEC meeting today, majority of analysts are expecting no significant rise in crude oil anytime soon. Note that crude oil and CAD are correlated.

Today released Trade balance data was 0.3 billion better than forecast but revision in previous release was 0.2 billion worse, which made this data insignificant for any further gains in CAD.

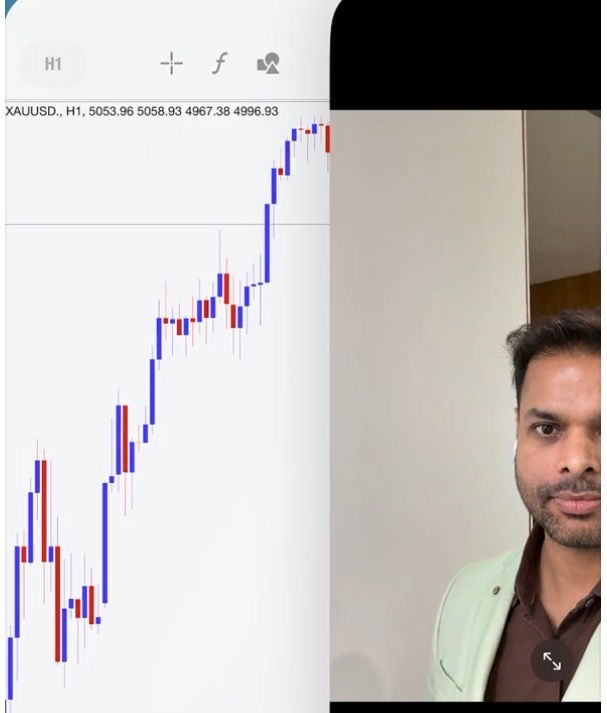

The triggering factor made an engulfing candle on H1 time-frame which was followed by next bearish candle of almost same size and price penetrated previous low. It strengthened change of retracement to the downside.

Recent poor economic data from the US increased probability of poor NFP. As well, mixed news of US-China trade deal coming from the White house kept USD/JPY weak. There is a huge similarity in USD/JPY and CAD/JPY. That's why we chose to sell CAD/JPY instead of buying USD/CAD.

Here is how we entered sell position:

Risk: If NFP comes better than forecast or if difference between revision (if any) and previous actual is more positive than negative deviation (in case of worse NFP) of actual release tomorrow, close the trade.

Trade closed: target reached