USD/CAD | Sep 19, 2019

- KeonConsultancy.com

- Sep 19, 2019

- 1 min read

Updated: Sep 20, 2019

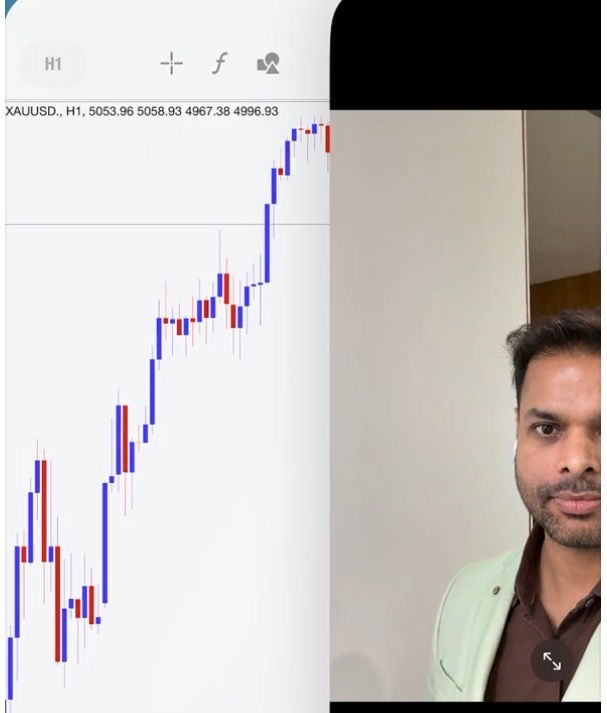

"If market is still under influence of BOC statement and Fed's rate cut probability, 1.3339 should not be broken. If H1 candle closes above 1.3339, the bearish setup will fail, 1.3339 was high of spike before BOC statement," I wrote in previous analysis of USD/CAD.

H1 candle didn't close above 1.3339 yet but influence of BOC and Fed rate-cut already seems to have faded. USD/CAD opened way lower than closing price of Friday and gave us chance to set SL to BE in sell trade but later it went up, filled gap and has made a channel. FOMC press conference didn't move USD/CAD lower. That's why we now believe that influence of BOC and Fed rate-cut has faded.

Therefore, we buy now to trade this channel. Target is upper border of channel.

Risk: it fails if price breaks below previous swing low.

Comments