Buy EUR/CAD | Sep 20, 2019

- KeonConsultancy.com

- Sep 20, 2019

- 1 min read

We analyse EUR/USD as well USD/CAD to determine trade setup on EUR/CAD because EUR/USD and USD/CAD are way more popular than EUR/CAD.

Since formation of double bottom on daily time-frame of EUR/USD, we have a short term bullish bias on EUR.

The downward move caused by FOMC press conference was erased by very gradual bullish move in EUR/USD yesterday. It shows that influence of so called hawkish Fed rate cut finished.

If you have read our USD/CAD analysis, you know that we have short bullish setup in a channel and other supporting fundamentals.

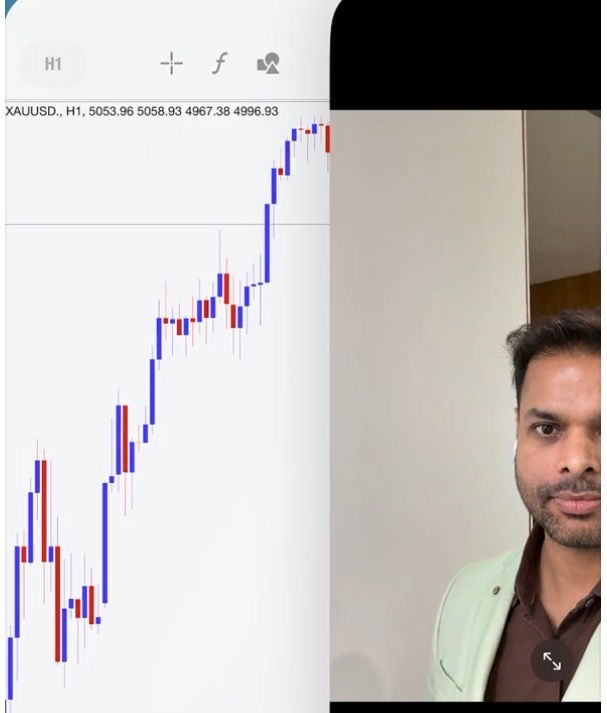

If USD/CAD is going to touch upper border of channel or at least break out or penetrate previous swing high on H1. And at the same time, EUR/USD is not bearish. EUR/CAD is more likely to erase previous swing down on H1. In addition to these factors, EUR/CAD has closed above blue line (XX hours - EMA) and RSI has crossed above 50 on H1.

Risk: If EUR/USD breaks down the triangle(s) and close below bearish move of FOMC or if USD/CAD fails, whichever occurs earlier; get out of EUR/CAD.

Target previous swing high. Or, close it if USD/CAD hits target.

Close at BE. EUR/USD has turned down but USD/CAD is bullish as per analysis. We are gonna get chance to close EUR/CAD at BE.